One way to determine the investment-worthiness of stocks is to look at those with the longest histories of consistently paying dividends. This approach is known as dividend growth investing. Dividend growth investors prefer undervalued stocks with a history of paying a dividend versus overvalued stocks that do not pay dividends. They believe that any company that cuts or suspends its dividend is obviously struggling. They also rationalise that dividends require real cash to pay shareholders, and thus serve as a reliable indicator of the company’s actual earnings and health.

Categories of Dividend Stocks

Dividend growth stocks can be broadly categorized as:

1. Dividend Achievers

This group consists of companies that have consistently raised their dividends for at least 10 consecutive years. Most of the companies in this group belong to the Consumer, Industrials, Financials, and Utilities sectors, such as Microsoft, Walmart and JM Smucker.

2. Dividend Contenders

These are stocks that have raised their dividends for between 10 and 24 years. It primarily consists of companies from the Finance, Industrials, and Utilities sectors, such as AbbVie, Home Depot, Huntington Ingalls Industries, and some local and regional banks.

3. Dividend Aristocrats

The companies in this group have raised their dividends for 25+ years. Their minimum market cap is $3 billion with a $5+ million average daily trading volume for the three months before the rebalancing date. These companies are typically large, well-established businesses that are mostly market leaders, such as IBM, Colgate-Palmolive and Coca-Cola.

4. Dividend Kings

This group has been raising its dividends for 50+ consecutive years. A limited number of companies have been able to fulfill this requirement, such as Federal Realty Trust, Emerson Electric, Johnson & Johnson and Proctor & Gamble.

When it comes to dividend growth investing, the history of raising dividends is the most important factor. So, Dividend Kings are one of the most sought-after stocks. However, it is also a smart idea to include undervalued stocks on the watch list that could deliver remarkable dividend increases in the future. That is why we recommend choosing some good stocks from the Dividend Aristocrats list as well.

Best Dividend Aristocrats for 2022

Dividend Aristocrats have an impressive history of annual dividend increases. Here are the best Dividend Aristocrats for 2022:

1. Enbridge Inc. (NYSE: ENB)

Enbridge Inc. is an energy infrastructure company with a history of 27 consecutive years of dividend increases. The company has declared its Q3 2022 dividend at $0.86, ex-div date of July 26. We expect Enbridge to raise its dividend to $0.886 by Q1 2023 and hold it steady for the remainder of the year.

2. International Business Machines Corporation (NYSE: IBM)

IBM is an integrated technology solutions giant, offering cloud services, customer information control systems, analytics and integration software solutions. Analysts believe that this company is well positioned for growth, profitability and sustainable shareholder returns due to expectations of rising demand for enterprise transformation solutions.

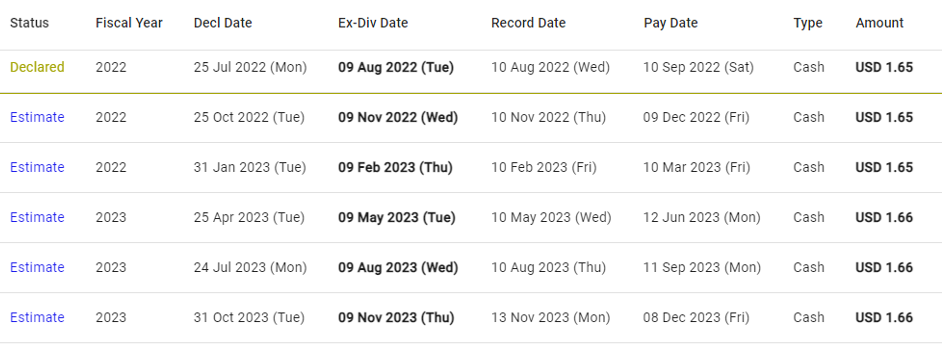

The company has declared its Q2 2022 dividend at $1.65, ex-div date of August 9. It is expected to raise its dividend in Q1 2023 to $1.66.

3. Universal Health Realty Income Trust (NYSE: UHT)

This is real estate investment trust operates in 20 American states and primarily focuses its investments on healthcare facilities. It has a history of 36 consecutive years of dividend increases.

Its last paid dividend was for Q2 2022 at $0.71. We predict that Universal Health Realty Income Trust will raise its dividend in Q1 2024 to $0.715.

4. Chevron Corporation (NYSE: CVX)

This American multinational energy corporation operates in more than 180 countries. It is ranked among the top dividend aristocrats for 2022 as it has been increasing its dividend payouts consistently for 34 years.

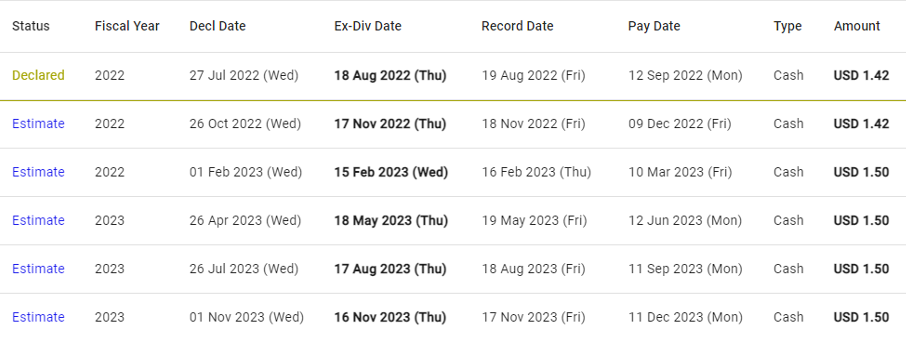

Chevron has declared its Q2 2022 dividend at $1.42, ex-div date of August 18. We predict that the company will raise its dividend in Q4 2022 to $1.50.

Best Dividend Kings for 2022

The Dividend Kings list consists of some of the most reliable dividend stocks. Take a look at some of the top-ranked Dividend Kings:

1. Stanley Black & Decker (SWK)

This company is a world leader in power tools, hand tools and related items, and ranked second in the areas of commercial electronic security and engineered fastening. It is a preferred Dividend King due to its history of delivering consistently growing payouts for the past 54 years.

The company has recently declared its Q3 2022 dividend at $0.80, ex-div date of September 2. It is expected to raise its dividend in Q3 2023 to $0.86.

2. 3M Company (MMM)

This company sells over 60,000 products used in homes, hospitals, office buildings and schools around the world. It employs more than 95,000 people and operates in over 200 countries. It has a history of 64 consecutive years of dividend increases.

3M’s last paid dividend was for Q2 2022 at $1.49, ex-div date of May 19. We predict that the company will raise its dividend to $1.50 by Q1 of 2023.

3. Lowe’s Companies (LOW)

This is the second-largest home improvement retailer in the US that operates or services more than 2,200 stores in the US and Canada. It is a preferred stock for investors because of its history of delivering consistently growing payouts to shareholders for the past 59 years.

Lowe’s declared its Q2 2022 dividend at $1.05, ex-div date of July 19. We expect the company to raise its dividend in Q2 2023 to $1.365.

4. Parker-Hannifin (PH)

This diversified industrial manufacturer specialises in motion and control technologies and has annual revenues of over $14 billion. It has paid dividends for 71 years and has increased its payouts for a remarkable 66 consecutive years.

The last dividend was paid for Q3 2022 at $1.33. We predict that Parker-Hannifin will raise its dividend in Q3 2023 to $1.54.

Powering Investment Decisions with Dividend Predictions

Investing in Dividend Aristocrats or Kings gives peace of mind that consistent passive income via dividend payouts can be depended on. Plus, holding such stocks for long periods of time tends to deliver strong long-term investment performance. At Woodseer Global, we employ a unique analyst+AI approach for dividend forecasting that ensures accuracy at scale. Contact us to learn how we can help you with dividend growth investing.

With Thanks to Matthew Riding