As Europe accelerates toward a carbon-neutral future, the continent’s utility giants are at the forefront of clean energy. Governments from Brussels to Berlin are mandating aggressive renewable energy targets, while investors continue to demand stable dividends in a turbulent global economy. This intersection, between long-term environmental commitments and near-term shareholder expectations, creates a new narrative of “green dividends.”

For income-focused investors, the European energy sector offers a compelling paradox. Companies like Enel, Iberdrola, and Ørsted are channeling tens of billions of euros into offshore wind farms, solar grids, and battery storage; investments that promise sustainable growth, but also test the limits of traditional dividend policies. Yet, despite these capital-intensive transitions, many of these firms remain committed to maintaining, or even increasing, their dividend payouts.

As Europe pushes forward with ambitious clean energy mandates, utility companies are rethinking their dividend strategies; raising important questions for investors about risks in the rapidly evolving sector.

The European Energy Transition Landscape

Europe has positioned itself as a global front-runner in decarbonization and clean energy initiatives. Under the European Green Deal, the EU has committed to reducing net greenhouse gas emissions by at least 55% by 2030 and achieving full climate neutrality by 2050 (European Commission, climate). Critical to achieve this, is the transformation of the power sector—one of the continent’s largest carbon emitters—into a system powered predominantly by renewable energy.

To achieve this, the European Commission and member states are pushing utilities to expand renewable generation, digitize electricity grids, and phase out fossil fuel dependence. As of 2024, over 40% of the EU’s electricity comes from renewables, with countries like Spain, Denmark, and Portugal leading in wind and solar integration (Eurostat). These policy directives are not merely aspirational, rather they are backed by binding regulations, carbon pricing mechanisms, and targeted subsidies that reward utilities for making quick transitions.

But such green energy transitions can be costly. According to experts, Europe’s top utility firms are expected to invest over €160 billion collectively between 2023 and 2027 in clean energy infrastructure, much of it needing to be front-loaded in order to meet interim 2030 climate targets (ING Global Market Research). While this spending fuels future growth and aligns with green energy shifting priorities, it raises a critical question for dividend-focused investors: Can these companies afford to keep paying reliable dividends while financing such ambitious transitions? The answer lies in the strategies and financial discipline of individual firms: some of which are proving that green investments and generous payouts don’t have to be mutually exclusive.

But, While Europe has taken an aggressive regulatory approach to decarbonization, this is not a universal trend. In the United States, climate policy has swung with electoral cycles; evidenced by the U.S. withdrawal from the Paris Agreement in 2017 and reentry in 2021, creating uncertainty for utilities. Meanwhile, in energy-exporting nations like Saudi Arabia, fossil fuel dependence continues to dominate long-term investment strategy. As a result, dividend trends in those regions are often shaped by oil market and political dynamics, not renewable investment mandates. This divergence reinforces the uniqueness of Europe’s “green dividend” era; one where policy, sustainability, and shareholder returns increasingly move in tandem.

Spotlight on Major European Utilities

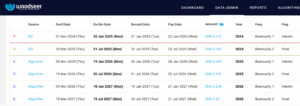

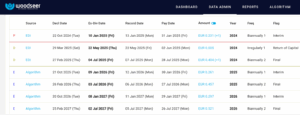

Enel, Italy’s largest utility provider, continues to demonstrate a commitment to both renewable energy investments and shareholder returns. In its 2025 Strategic Plan, Enel announced a dividend of €0.47 per share, marking a 9% increase over the previous year (Enel). This dividend comprises an interim payment of €0.215 in January and a final payment of €0.255 scheduled for July (Woodseer). Enel’s investment strategy includes allocating approximately €43 billion by 2027, with significant emphasis on power grids and renewable projects (Reuters). Despite the substantial capital expenditures, Enel maintains a dividend payout ratio of around 70%, reflecting a balance between growth initiatives and shareholder rewards.

Iberdrola, a Spanish utility company has also shown a strong commitment to increasing shareholder value and meeting green targets. In 2025, the company paid an interim dividend of €0.231 per share in January and plans to distribute a final dividend of at least €0.404 per share in July, totaling €0.635 per share for the year—a 15% increase from 2024 (Woodseer). Iberdrola’s strategic plan for 2024-2026 includes investments of €41 billion, focusing on network enhancements and renewable energy projects . The company anticipates paying out €11 billion to shareholders during this period, up from €9.5 billion in the previous cycle, indicating a robust approach to dividend growth alongside sustainable investments (Iberdrola).

Ørsted, a Danish energy company has taken a different approach amid financial challenges. Facing project delays and cost overruns, Ørsted suspended dividend payments for the financial years 2023-2025, with plans to reinstate them in 2026 (The Guardian). The company is implementing a “reset plan” to enhance efficiency and strengthen its capital structure, including a DKK 210-230 billion investment program from 2024 to 2030 (Ørsted). While the suspension may concern income-focused investors, Ørsted’s long-term commitment to offshore wind projects and renewable energy positions it for potential growth and dividend reinstatement in the future.

Key Considerations for Dividend Investors

For dividend investors, Europe’s green utility transition presents both opportunity and complexity. At first glance, the idea of massive capital outlays for renewable infrastructure might raise red flags; as historically, large investment cycles have coincided with dividend cuts. But as the examples of Enel and Iberdrola show, some of Europe’s largest utilities are managing to finance growth and sustain, even grow, their dividend payouts.

For example, Enel’s 2025 payout of €0.47 per share, up 9% from the prior year, and Iberdrola’s projected €0.635 per share, up over 15% year-over-year, signal confidence in their underlying cash flows. Both firms have also reaffirmed their commitment to dividend policies that maintain payout ratios in the 40–70% range; key comfort metrics for income-seeking investors in mature sectors like utilities. This suggests that due to stable regulated revenues (e.g., from national power grids) and access to green financing, these companies are in a strong position to service both infrastructure projects and shareholder rewards.

Furthermore, as ESG (Environmental, Social, Governance) considerations become more central to investment strategies, dividend-paying green utilities are gaining appeal. Individual and institutional investors alike are seeking income-producing assets that align with sustainability mandates. Thus, green utility companies that pay reliable dividends provide a positive outlook for investors who want both sustainable impact and financial returns.

Potential Industry Challenges

While the narrative around green dividends is promising, real and emerging risks that could disrupt returns remain a possibility. Transitioning to a low-carbon energy system is not a linear process; it’s capital-intensive, politically sensitive, and often unpredictable.

Principally, utilities operate in one of the most heavily regulated sectors in Europe. Favorable government policies, such as subsidies for renewables or carbon pricing mechanisms, can help drive investment returns. But political changes or budget constraints can also reverse these policies quickly. For example, recent debates in Germany and the UK over the pace and cost of the energy transition have led to subsidy reductions and public backlash against rising energy prices (Politico). For investors, this creates uncertainty. If governments scale back support or change tax rules, companies may face economic pressure, slowing their ability to maintain payouts. Thus, tracking regulatory trends country by country, as the operating environment for an Iberdrola (Spain) may differ significantly from that of Ørsted (Denmark) or RWE (Germany), is essential.

Moreover, although utilities have stable cash flows, the sheer size of renewable infrastructure investments, often in the tens of billions, can limit free cash available for dividends. Companies that are overly ambitious with rapid infrastructure development may be forced to cut or suspend dividends temporarily. This is especially true for firms expanding into newer, more volatile sectors like offshore wind, green hydrogen, battery storage, and other new green technologies, where long payback periods and project risk are high. Such is seen with Danish company, Ørsted; where the company had to suspend dividends to counteract costs associated with supply chain disruptions and sustainable wind energy project cancellations in the US.

Europe’s clean energy transition is not just reshaping the continent’s energy grid; it’s transforming the financial blueprint of its utility sector as well. As governments enforce aggressive decarbonization mandates and utilities respond with multibillion-euro investments in renewables and infrastructure, dividend policies are evolving in tandem. For some utility companies it’s possible to fund a greener future while still delivering consistent returns to shareholders; with growing payouts suggest that green dividends are achievable. But for others, regulatory shifts, project delays, and rising capital costs, challenge utility companies’ dividend payouts.

For dividend-focused investors, the key takeaway is that while opportunities for “green dividends” are plentiful, careful selection is essential. The most successful utilities in this evolving landscape will be those that not only lead the shift toward clean energy but also maintain strong financial discipline and transparency.

Written and Researched by Prakriti Saxena