The recent persistent rise in inflation is primarily a consequence of economies getting overheated in the aftermath of significant pandemic-led stimulus measures. Annual inflation in 15 of the 34 advanced economies ran higher than 5% through December 2021. A similar trend was seen in 78 of the 109 emerging and developing economies. In the US, annual inflation surged highest since 1982, at 7.5%, as of January 2022.

With the Russian invasion of Ukraine and the ensuing sanctions, inflation may become an increasingly painful issue for policymakers and governments. The IMF had already downgraded its global growth forecast to 4.4% for 2022, and the US Federal Reserve is expected to aggressively pursue a monetary tightening policy this year. How will all this impact on dividend investors and Woodseer’s forecast data?

Conventional knowledge says that rising inflation leads to an increase in the cost of capital and erosion of purchasing power. This can lower profits and the dividend-paying capacity of companies. However, inflation doesn’t impact all sectors of the economy equally. Moreover, companies that pay high dividends often have cyclical and defensive business models that help them counter rising inflation.

Impact on Production and Distribution

The impact of inflation is positive for production activities. Producers benefit from rising prices, as they can earn more profits from the sale of products. So, they tend to increase production by utilising all resources available to them. For instance, Altria Group Inc., one of the world’s largest producers and marketers of tobacco and related products, saw a 21% gain in its stock price in 2021. The company also consistently paid dividends in 2020 and 2021.

However, if wages start to rise along with production costs, the positive impact starts to wane. This is primarily when inflation is of the cost-push type. For instance, depreciation or appreciation in the domestic currency’s exchange rate impacts the cost of imports.

Distribution companies face added pressure from a surge in inflation due to the nature of their business. Customer purchases can decline due to inflation. The cost of delivery also increases with rising fuel prices. Together with increased inventory costs, these factors impact gross profits for companies.

Impact on Exports

Inflation impacts exports primarily through its influence on currency exchange rates. Higher inflation tends to push central banks to raise interest rates to keep price levels under control. This leads to an appreciation in the domestic currency, with other economic fundamentals stable. A stronger currency hurts exports. For instance, the US trade deficit widened by 27% to reach $859 billion in 2021, as imports surged higher than exports amid rising inflation.

Typically, the industrial and commodities sectors bear the brunt of this rise in currency value. A rise in interest rates also makes it difficult for them to borrow money to fund their operations.

The Link between Oil and Inflation

Oil prices and inflation share a cause-effect relationship. As a major input in the economy, oil price hikes tend to increase general price trends and, thus, inflation. For instance, in the 1970s, when oil price rose from $3 before the 1973 oil crisis to over $30 by the end of 1979, the US CPI doubled from 41.20 in early 1972 to 86.30 by the end of 1980.

This is why many investors might consider energy stocks that pay dividends to protect them during an inflationary period. For instance, with the price of WTI crude rising more than 30% since Q4 2021 and higher demand due to the post-pandemic recovery, the energy sector has been performing well. Exxon Mobil’s upstream segment gained 54% in Q3 2021, helping it generate $48 billion worth of operating cash flow. The company paid out $3.8 billion in dividends to shareholders in Q4.

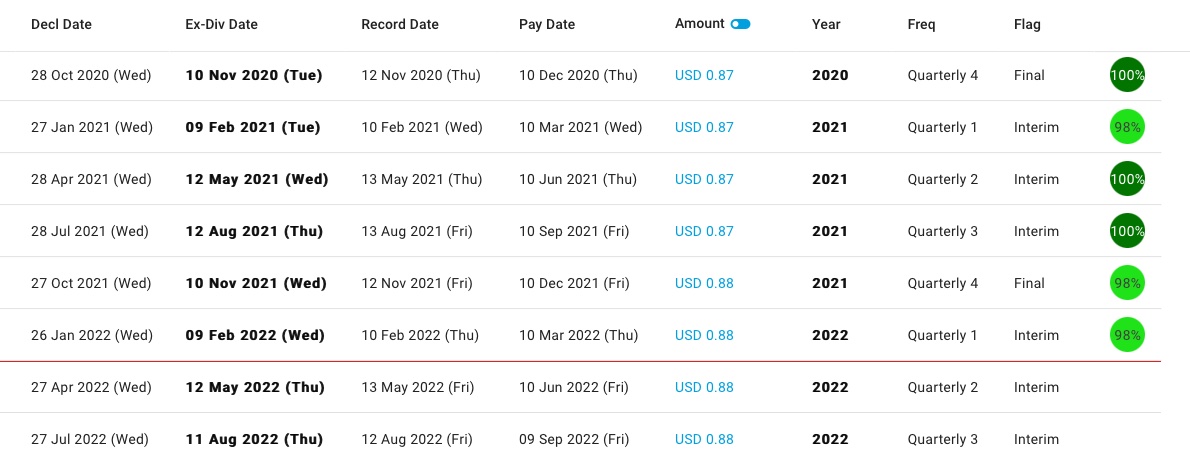

Woodseer – XOM dividend history & forecast data as at 2022/03/15

Correlation between Inflation and Commodities

Apart from oil and gas, commodities like precious metals and agricultural goods also act as portfolio diversifiers to protect against inflation. Global commodities are priced in US dollars, so a strong dollar means lower commodity prices and vice versa. A stronger US dollar tends to affect inflation through commodity prices, rather than consumer goods. This makes commodity prices one of the leading indicators of domestic inflation.

Lessons Learnt from the Past

The current inflation numbers are very high, not seen since the 1960s and 1970s, when oil prices were at record highs, or since the 2008 commodity boom. Looking at these past instances is important to see what could occur this time around.

At some point, it’s estimated the US Fed will decide to raise interest rates to reduce liquidity in the market and bring it to equilibrium. Analysts predict this will happen in March 2022, as indicated by Fed Chairman Jerome Powell. The Bank of England also raised rates for the second time in 3 months in February 2022.

This will bring about rapid changes in the economies, which means investors might need to make changes in their portfolios. With a rise in risk-free rates, money will eventually begin to leave the capital markets, leading to a drop in stock prices. Short-term investors could suffer losses. There could also be increased risk of defaults due to rising variable rates and erosion of capital market profits.

Investors need to look out for consumer debt warnings from credit card companies, property prices and the US non-farm payroll data to evaluate the changes needed in their strategies.

Dividend-Paying Stocks Could Protect Against Inflation

With inflation unlikely to subside anytime soon, investments in dividend-paying stocks could be a good option: research shows that stocks that increase dividend pay-outs during periods of high inflation tend to outperform the broader market on average. Additionally, dividends can help support returns when the stock market is volatile and stock prices struggle. For instance, during the high inflation period of the 1940s and 70s, dividends accounted for 65% to 71% of the S&P 500’s returns, respectively.

A company that pays dividends during challenging times should have the qualities needed to sustain this growth mode due to excess free cash flow. This is a significant aspect to consider today when the market has an unusually large number of unprofitable or marginally profitable companies.

Assessing Dividend Paying Potential the Woodseer Way

The bottom line is that inflation could increase expected future dividend payments. However, higher inflation also tends to increase inflationary expectations, which lead to higher discount rates, reducing stock prices.

It’s tricky to find a balance during times like these. There are several companies today that are reinstating dividends due to post-pandemic business recovery. Many of them have paid down their debt aggressively in the last few years and have a solid business roadmap. Woodseer, with our analyst+algorithm forecast technique, can help portfolio managers find stocks that could provide portfolio protection against rising inflation, across the global markets.

Contact us to learn more.