There is a very visible ongoing shift to an on-demand, rental-first economy in most parts of the world. One of the biggest shifts is occurring in the UK, where the homeownership rate declined from 70.9% in 2003 to 65.5% in 2018, according to the latest statistics. This rate is comparatively lower than many other countries in Europe, such as Croatia and Romania, where the homeownership rate stands at over 90%.

Another classic example of a predominantly rent economy in Europe is Germany. The homeownership rate in the nation is among the lowest among the developed economies, although Switzerland comes close to beating Germany in terms of rental levels.

The result of this shift is that there is a mismatch between demand and supply, especially in the UK rental market. Private residential rental prices have been rising at their fastest rate in the country since July 2016, albeit with regional variations. Annual rental growth hit a high of 11% in April 2022, with rental demand up 6% but available properties declining 50% over the previous year. This was followed by another surge of 9% in home rental prices in June to set a new record high.

Why is Rental Demand on the Rise?

One of the key reasons for the decline in home ownership and a concomitant rise in rental demand is the lack of housing affordability. The UK scores below many of its developed peers in terms of the ratio of house prices to disposable income. The lack of housing affordability has led the younger generations and lower-income families to choose privately owned rental homes and social rental housing.

The average house price in the UK hit a record high of £289,099 in May 2022, with the price being even higher in the major cities. This means that the 15% deposit that buyers need to pay upfront becomes too expensive. Then there is the interest rate, which is currently at its highest in the last 40 years. Plus, there is the cost of stamp duty.

Now, the rule of thumb for home maintenance is that the cost of maintaining the property should come to 1% of the home’s value per year. This means homeowners will need an additional £2,890 for the upkeep of their house. Altogether, the costs make ownership prohibitive.

Several other reasons are driving the demand for rental housing, not the least of which are rising inflation, the soaring cost of living and record house prices. Some of the other reasons include:

- High upfront costs

- Large ongoing financial commitments

- Rising interest rates

- Less flexibility and freedom

Also, the 2008-09 crisis has led to long-lasting concerns that property values could plummet at any time, leaving property owners in the red. No wonder then that the UK has seen a rise of 1.1 million in the number of rental homes over the last decade.

However, the shift to a rent economy means that capital ownership moves out of the hands of the consumer and into the hands of corporations, such as build-to-rent developers. How does this shift impact your investment strategies? It might help to look at the winners in this situation.

Best Real Estate Stocks to Invest In

Rent economies aren’t limited to residential properties. Commercial and industrial properties are also being rented on a large scale by companies of all sizes and for all types of needs, from cell tower sites to data storage and even research properties for pharma businesses. So, even if investing in real estate might not be affordable at present, investors could earn passive income through real estate stocks that pay dividends. So, here’s a look at some of the most promising ones.

Realty Income Corporation (NYSE: O)

Founded in 1969, this REIT is known for the monthly income it offers investors. The company has been paying dividends ever since it went public in 1994. It has a rapidly growing portfolio of over 11,000 properties across the US, UK and Spain. Another positive in favour of the company is its commitment to minimising its environmental impact. Realty Income Corp. has launched the Green Financing Framework to raise funds to acquire and develop green-certified buildings and other projects.

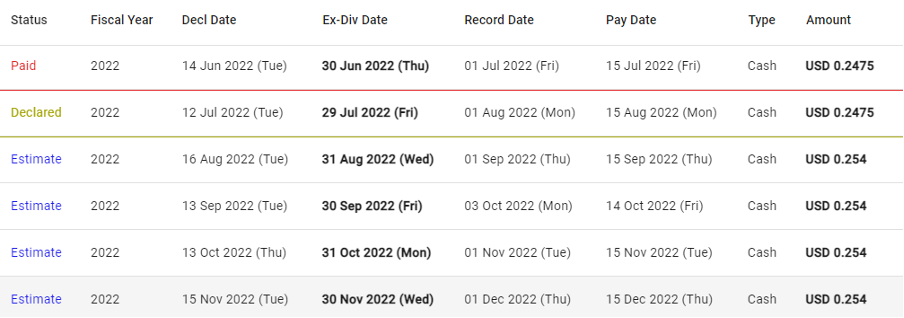

The company has declared its July dividend at $2.475, ex-div date of July 29. We expect Realty Income to raise its dividend to $2.54 by September 2022.

Prologis, Inc. (NYSE: PLD)

This logistics real estate firm is focused on high-growth, high-barrier markets. It currently serves about 5,800 customers in the B2B and retail/online fulfillment segments. As of March 2022, Prologis owned or had investments in development projects and properties estimated at a total of 1 billion sq. ft across 19 countries. The company also had $214 billion in assets under management and an annual net operating income of $3.5 billion.

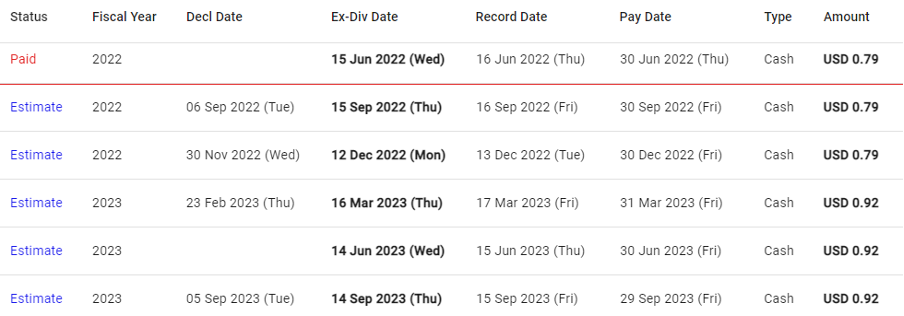

The company has a 23-year history of consistent dividend payments, with the last paid dividend being for Q2 2022 of $0.79. We predict that Prologis will raise its dividend in Q1 2023 to $0.92.

W.P. Carey, Inc. (NYSE: WPC)

This company is a net-lease REIT that structures its terms to keep pace with inflation. Almost 100% of WP Carey’s leases include rent increases, 60% of which is tied to inflation. At present, the company owns 1,336 office, retail, industrial, self-storage and warehouse properties that translate into 157 million sq. ft. of rental space. WP Carey also boasts borrowing capacity of $2.4 billion on its credit line, without any major debt maturities till 2024.

The company paid its Q2 2022 dividend at $1.059, ex-div date of June 29. We expect WP Carey to hold its dividends steady through the remainder of 2022 and in 2023.

Powering Investments with Dividend Forecasting

While real estate ownership might not seem to be the best investment strategy for now, portfolio managers can certainly aim to satisfy their clients through passive income via stocks associated with the property market. This is where Woodseer Global can help. Our analyst+AI approach to dividend forecasting ensures accuracy at scale and is trusted by the world’s largest investment firms. With cutting-edge technology taking care of the calculations, our analysts are able to focus on providing responsive support regarding predictions, reviewing special cases and more. Contact us to learn more.

With thanks to Matthew Riding, Alicia Hundley and Claire Richardson.