We recently reviewed our 90-day forecast accuracy for SPY and are pleased with the results.

Woodseer uses a bottom-up approach to calculate ETF dividend forecast amounts – combining ETF composition data (from our partner Ultumus) with our single name forecasts for the underlying constituents on a proportional basis.

SPY is routinely in the top 10 most popular ETFs – tracking the S&P 500 – certainly a key one to get right wherever we can.

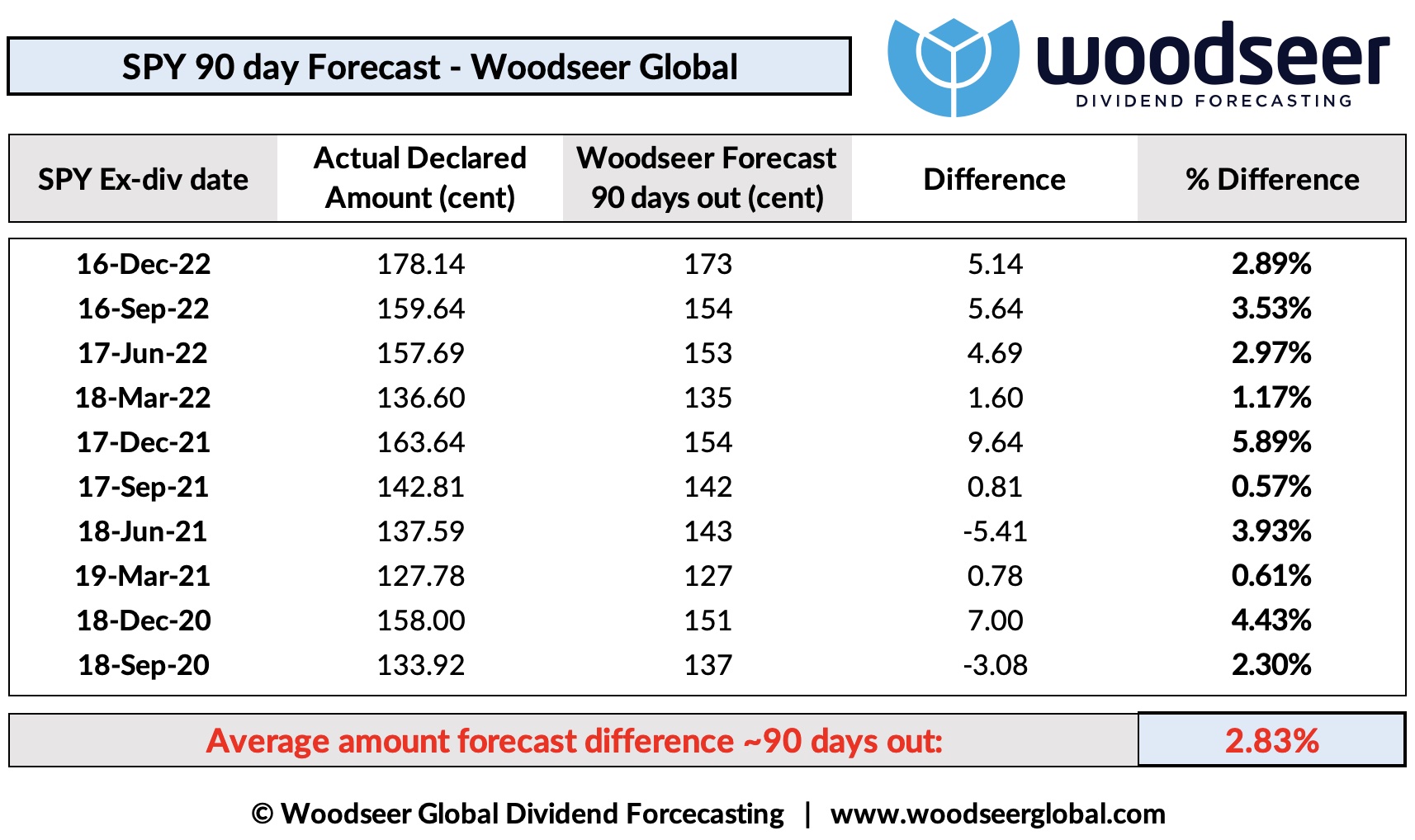

SPY pays quarterly dividends and we’ve looked back

at the past ten dividends since September 2020.

Summary

- We have a mean average difference (between our 90 day forecast amount and the actual declared amount) of just 2.83%

- Only one of the past 10 dividends was off by more than 5%, in Dec. 2021 (5.9%)

- The average 90-day forecast accuracy for the four dividends in 2022 was 2.64% – averaging $0.0427

- The average discrepancy over all ten dividends is $0.0438

We believe this high degree of accuracy – at 90 days out no less – speaks to:

- the quality of our S&P 500 dividend forecast data

- the effectiveness of our ETF calculation methodology

To receive the underlying data we analysed, a sample, or to learn more about how we can make and save you money with you SPY trades – get in touch directly now.