Earnings season is an exciting time for the stock market. Every announcement can affect the share price. Whether you’re focused on share price or dividends, these earnings releases are important. This is because the dividend paid by the company usually comes from the earnings. While the earnings per share (EPS) and the dividend both reflect a business’ profitability, EPS is more of an accounting figure and does not reflect the returns for shareholders.

Now, companies issue dividends in the form of cash or additional shares, called stock dividends, to reward shareholders for their investment. Once these dividends are paid, a company’s retained earnings and cash are reduced by the total value of the dividend. So, the dividend per share (DPS) can be said to represent the portion of the company’s earnings actually paid out to each shareholder. This makes it important to consider both DPS and EPS to understand the company’s performance.

So, which should you follow for investing decisions – EPS or dividend? It all depends on the investment horizon, goals and tax repercussions. Dividends are better for regular income, while earnings might be a better choice for growth-focused investments. The fact is that both impact the share price of the company.

In the short term, share prices typically drop after the dividends are distributed. Conversely, a stock can dip if investors think a company is paying out too much of its profit in dividends, since it will leave less cash for reinvesting in new ventures.

So, here’s a look at some of the most awaited earnings reports for this August and the dividend history of the companies.

Best Stocks to Invest Before August Earnings Reports

1. Cisco Systems, Inc. (NASDAQ: CSCO)

Cisco designs, manufactures and sells Internet Protocol-based networking and other solutions related to the communications and information technology industry. It operates in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan and China.

Cisco Systems is scheduled to report its earnings on August 17, 2022, before market open. Analysts expect the company to report earnings of $0.73 per share for the quarter, lower than the EPS of $0.76 reported a year ago.

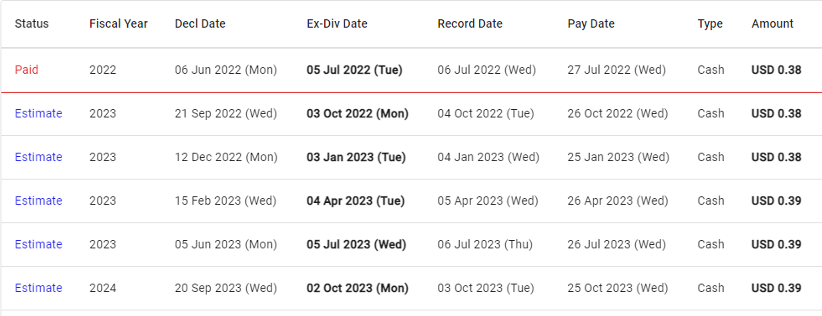

The last paid dividend was for Q4 2022 at $0.38, ex-div date of July 5, 2022. We predict that Cisco Systems will raise its dividend in Q3 2023 to $0.39.

2. Applied Materials, Inc. (NASDAQ: AMAT)

This company offers manufacturing equipment, services and software to the semiconductor, display and related industries. It was incorporated in 1967 and currently operates in the United States, China, Korea, Taiwan, Japan, Southeast Asia and Europe.

Applied Materials is expected to report its earnings on August 18, 2022, before market open. Consensus expectations for the EPS stand at $1.78, a decline from the $1.90 reported a year ago.

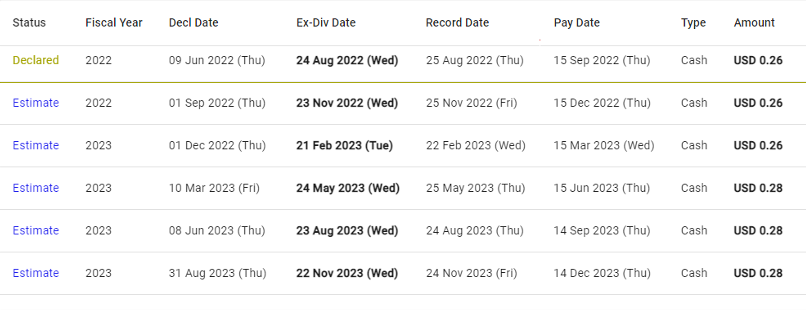

The company has declared its dividend for Q3 of 2022 at $0.26, ex-div date of August 24. We expect Applied Materials to raise its dividend to $0.28 by Q2 of 2023 and hold it steady for the remainder of the year.

3. NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA provides graphics, computing and networking solutions in the United States, Taiwan, China, and several other countries.

The company is expected to report its earnings on August 24, 2022, before market open. Wall Street predicts earnings at $0.84 per share for the quarter, down from $0.89 reported for the same quarter of 2021.

The last paid dividend for Q1 2022 was $0.04, ex-div date of June 8. We predict that NVIDIA Corporation will hold its dividend steady through 2023.

4. The Gap, Inc. (NYSE: GPS)

This retail giant offers apparel, accessories and personal care products for men, women and children. As of December 31, 2021, it had 2,835 company-operated stores and 564 franchise stores. It also offers its products through e-commerce sites.

Gap is scheduled to report its earnings on August 25, 2022, before market open. The consensus estimate for EPS stands at -$0.05, a significant drop for the Q2 2021 EPS of $0.7.

The last paid dividend for Q1 2022 was $0.15, ex-div date of July 5. We expect Gap to raise its dividend to $0.20 in the next quarter and hold it steady for the rest of the year.

5. Dollar General Corporation (DG)

This discount retailer provides different merchandise in the Southern, Southwestern, Midwestern and Eastern United States. As of February 25, 2022, it operated 18,190 stores in 47 states in the country.

Dollar General is expected to report Q2 earnings on August 25, 2022. Analysts predict the Q2 EPS at $1.57, up from $1.23 a year ago.

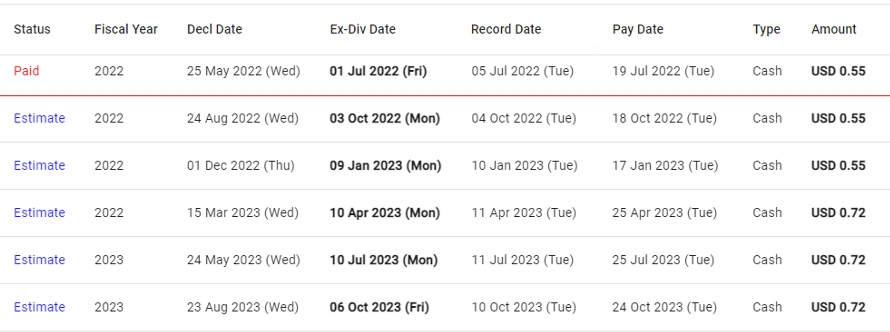

The last paid dividend by the company was for Q1 2022 at $0.55, ex-div date of July 1. We predict that Dollar General will raise its dividend to $0.72 in Q4 2023.

1. HP Inc. (NYSE: HPQ)

This company offers personal computing and other access devices, imaging and printing products, along with related technologies, solutions and services in the United States and internationally.

HP Inc. is expected to report earnings on August 30, 2022. Consensus EPS expectations stand at $1.05, up slightly from the $1.00 reported a year ago.

The company has declared its Q4 of 2022 dividend at $0.25, ex-div date of September 13. We expect HP Inc. to raise its dividend to $0.299 in the next quarter and hold it steady through 2023.

Making the Best Investment Decisions with Dividend Forecasting

While there is fairly easy access to earnings forecasts for every company, dividend predictions are not as easy to come by. This is where Woodseer Global can help. With our revolutionary analyst+AI approach to dividend forecasting, we ensure accuracy at scale. Use our industry-leading forecasts to pick the best stocks. Contact us to know more.