When two of the world’s biggest banks have made wildly different predictions about oil prices, making an investment in the energy sector becomes extremely confusing. JPMorgan Chase analysts forecast that oil prices could cross a “stratospheric” $380 a barrel if Russia decides to retaliate against the sanctions imposed by the G7 countries by cutting its crude oil output.

On the other hand, Citigroup analysts predict that oil prices might collapse to $65 a barrel by the end of 2022. They could possibly even slump to $45 by the end of 2023 in the absence of any intervention by OPEC+ producers and a decline in oil investments. So, it looks like volatility is here to stay in the oil markets for some time, making the right investment decisions even more challenging.

The Problem with Predicting Oil Prices

Oil prices have surged meteorically so far this year on tight supplies. In fact, the price of Brent Crude surged around 50% in the first half of 2022 as the geopolitical crisis between Russia and Ukraine disrupted the oil space. While OPEC and its allies have decided to boost output by another 648,000 barrels a day in August, experts think this will still be insufficient to balance out the market.

Some major factors that could affect oil prices in the remainder of 2022 and into 2023 are:

1. Russia-Ukraine Conflict and Sanctions

The G7 leaders have recently announced their plans to cap the price of Russian oil and keep up the pressure on Moscow over its invasion of Ukraine. JPMorgan analysts believe that if Russia dramatically slashes production in response to these caps, crude oil prices could surge 240%. So, if Moscow reduces its oil production by as much as 5 million barrels per day, it could spell disaster for the global oil markets.

2. Uncertain China Demand

While some analysts expect China’s crude imports to surpass the 10.23 million b/d level seen in January-June this year, others think that the volumes could fall to about 10 million b/d.

The country’s crude stocks reached an 11-month high of 944.37 million barrels in May. Analysts posit that Chinese refineries would prioritize destocking the high-priced crude inventories prior to bringing in additional streams. Moreover, China’s domestic demand recovery has been slower than expected. Gasoline and jet fuel consumption did increase during the ongoing summer holidays this year, but sporadic movement controls threaten that growth. Analysts also say that the demand from the construction sector is poor due to cash flow problems.

Additionally, Beijing’s policy to cut oil product outflows by issuing limited export quotas to ensure domestic supplies and tackle global inflation while reducing emissions to meet the country’s net-zero targets may also restrict the country’s crude demand.

3. OPEC’s Predictions

OPEC’s global economic growth forecast for this year was 3.5%. However, its growth forecast for 2023 has been cut to 3.2%, despite assumptions that the Russia-Ukraine war will not escalate further and that risks such as inflation will not take a heavy toll on global economic growth.

OPEC has also predicted that the world will need 30.1 million bpd in 2023 from its members to balance the market, up 900,000 bpd from 2022. But it is difficult to imagine that the group and its allies, including Russia, can meet the demand since they are already struggling to deliver on pledged output hikes in 2022 to unwind huge cuts made in 2020.

The seemingly unchecked rally in oil prices over the past year has made it harder for energy investors to choose the right oil and gas stocks. Those still looking to make an investment in the energy market know that the best time to invest in oil and gas stocks is when they are down (along with oil prices), which isn’t the case right now.

So, why not take a look at alternative energy stocks that could prove to be a more prudent investment choice right now?

Top 5 Alternative Energy Stocks to Invest In

1. Brookfield Renewable Partners (NYSE: BEP)

This company operates one of the world’s largest publicly traded, pure-play renewable power platforms. Their portfolio includes hydroelectric, wind, solar and storage facilities in North America, South America, Europe and Asia. Their distribution has grown at a 6% compound annual rate over the last decade.

The company declared its Q2 of 2022 dividend at $0.32, ex-div date of August 30. We expect Brookfield Renewable Partners to raise its dividend to $0.337 by Q4 of this year.

2. NextEra Energy Partners (NYSE: NEP)

NextEra Energy acquires, owns and manages contracted clean energy projects in the US. It includes contracted renewable generation assets, consisting of wind and solar projects of around 8 GW. It has nearly doubled its quarterly dividend in the last five years.

The company declared its Q3 2022 dividend at $0.425, ex-div date of August 29. We expect NextEra Energy to raise its dividend to $0.4675 by Q1 2023 and hold it steady for the remainder of the year.

3. Clearway Energy Inc. (NYSE: CWENA)

Clearway Energy is one of the largest developers and operators of clean energy in the United States with over 5 GW of wind and solar projects and more than 2.5 GW of natural gas generation facilities.

The company has declared its dividend for Q2 2022 at $0.3604, ex-div date of August 31. We predict that Clearway Energy will raise its dividend in Q1 2023 to $0.39.

4. Iberdrola SA (MCE: IBE)

This company engages in the generation, transmission, distribution and supply of electricity (primarily from renewable sources) in Spain and internationally. It has a total installed capacity of 58,320 MW, including 38,138 MW of renewable installed capacity.

The last paid dividend was for the second half of 2021 at €0.274, ex-div date of July 8. We predict that the company will cut its dividend for the first half of 2022 to €0.179 and then raise it to €0.289 in the second half of the year.

5. Phillips 66 (NYSE: PSX)

This diversified energy company processes and markets fuel worldwide. Based out of Houston, Texas, the firm is active in natural gas trade and supplies chemicals and specialty products to the global markets.

In Q1 of 2022, Phillips 66 generated a strong operating cash flow of $1.1 billion and returned $404 million to stockholders in the form of dividends.

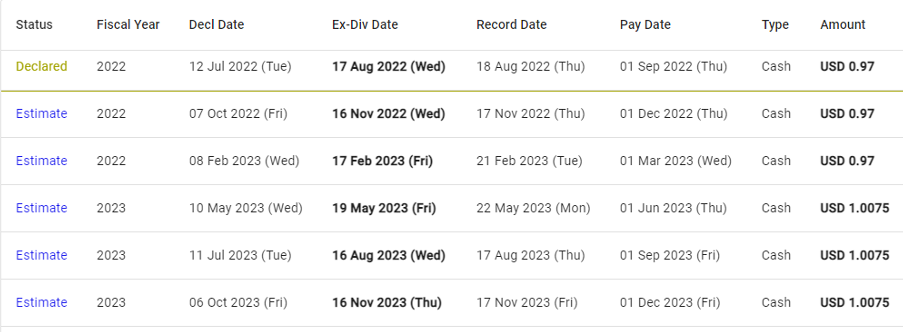

The company declared its Q2 of 2022 dividend at $0.97, ex-div date of August 17. We expect Phillips 66 to raise its dividend to $1.0075 by Q1 2023 and hold it steady for the rest of the year.

Making Investment Decisions with Accurate Dividend Forecasting

Predicting the future of dividends can be a challenging task even for sectors other than energy. At Woodseer Global, we employ a unique analyst+AI approach for dividend forecasting that ensures accuracy at scale. We can help you navigate the volatile markets to choose the best stocks for informed investment management. Contact us to find out more.