After two very rough years, the global airline industry is hoping to recover in 2022. Rising vaccine coverage, especially in developed economies where the largest demand for air travel comes from, along with the relaxation of border restrictions, is expected to push the industry forward.

However, the recovery is unlikely to be linear. Different countries are recovering at a different pace. While business travel recovery is slowly gaining ground, outbreaks of new variants could easily change the scenario.

Factors That Could Impact Stock Performance

In the US, surging Covid-19 cases due to Omicron, caused staffing shortages over the holiday season. Thousands of flights were cancelled during this time, which continued into the new year. Major airlines doubled or tripled pay to pilots to ease staff disruptions.

However, investors shrugged off these concerns, remaining optimistic about a rebound in travel during the year, pushing many airline stocks higher on January 3, 2022. United Airlines rose more than 4%, as did American Airlines. Delta surged by 3.1%, Southwest 2.3%, and JetBlue rose 2.7%.

Airline stocks further received a boost from Bank of America’s positive outlook for the airline industry, which stated that the top performers in the sector could be Delta Air Lines Inc., Frontier Group Holdings Inc., and Alaska Air Group Inc.

Potential outbreaks, renewed restrictions, and slower rebound in corporate travel are some of the risks that still remain. Lower demand for business travel could lead to margin pressures, contributing to higher ticket prices. Ticket prices will be further impacted by rising debt levels. Between 2019 and 2021, the top 6 airline companies in the US and Europe accumulated $44 billion in net debt, which is more than their pre-pandemic EBITDA levels. This will take years to repay, even with a rebound in 2022.

Will the rebound translate into better dividends from airline stock holdings? Let’s look at some of the top airline stocks that could pay dividends this year – and let us know if you agree or disagree.

1. Delta Airlines

Delta Airlines started 2022 on a good note, with high Q4 2021 earnings. This was the highest since late 2019, due to strong holiday and business bookings. The company recorded sales of $9.47 billion, beating expectations of $9.21 billion. Despite continuing challenges, the company shared profits worth $108 million with its 75,000 employees. Earnings are expected to grow 225.7% on a YoY basis in 2022. The stock remains a favourite for analysts due to the company’s strong balance sheet, cheaper valuation, and higher capacity discipline than the competition.

However, the airline expects a weaker Q1 2022, due to the increase in Omicron cases. With rising fuel inflation, Delta is still a long way from paying dividends. The last time Delta announced a dividend was on February 6, 2020, ex-div date Feb 19, 2020, of $0.4025.

2. American Airlines Group Inc.

Revenue for American Airlines Group for Q4 2021 stood at $9.4 billion, 17% lower than the same period in 2019. Net losses came in at $931 million. Despite the highest revenue in a pandemic quarter, the company suffered a loss due to demand volatility and cancelled bookings due to Omicron. The company expects its revenue to be up to 22% lower in Q1 2022, as compared to the same period in 2019.

The company hasn’t paid dividends after February 2020. On January 22, 2020, it declared a dividend of $0.10, ex-dividend date February 4, 2020. We do not expect the company to pay a dividend in 2022.

3. United Airlines Holdings Inc.

Despite facing headwinds from a surge in Omicron, the United Airlines met the financial guidance targets for Q4 2021. In 2021, the company posted $24.6 billion in revenue and a net loss of $1.964 billion. This is in comparison to a $3 billion profit in 2019 and $7.1 billion in net loss in 2020. In Q3 2021, the company had posted net income of $473 million due to the $1.13 billion support from the federal payroll aid. Q3 sales also rose higher than expected.

United Airlines does not pay dividends and is unlikely to start any time soon, given the rising fuel costs, uneven demand, and more than $30 billion in debt.

4. Southwest Airlines

Southwest Airlines posted a $68 million profit in Q4 2021, its first in 2 years without federal aid. Its net income for 2021 was $977 million. Incidentally, 2021 marked the company’s 50th anniversary. It opened 14 new airports and entered into a deal with Boeing to buy 100 of its 737 Max 7 planes, as it retired old ones. The company also introduced an industry-standard corporate booking system through multiple Global Distribution System (GDS) platforms. Despite the challenges, the airline accrued $230 million in employee profit sharing in 2021.

Southwest has not paid a dividend since March 2020, and its last cash dividend pay-out was $0.18. There is uncertainty regarding whether it will resume dividends in 2022.

5. International Consolidated Airlines Group

International Consolidated Airlines posted revenue (TTM) of $7.12 billion for 2021, a 20% decline from 2019. The company is expected to release its Q4 2021 earnings on February 25, 2022. Total revenues for 2022 are expected to increase by 153.1%.

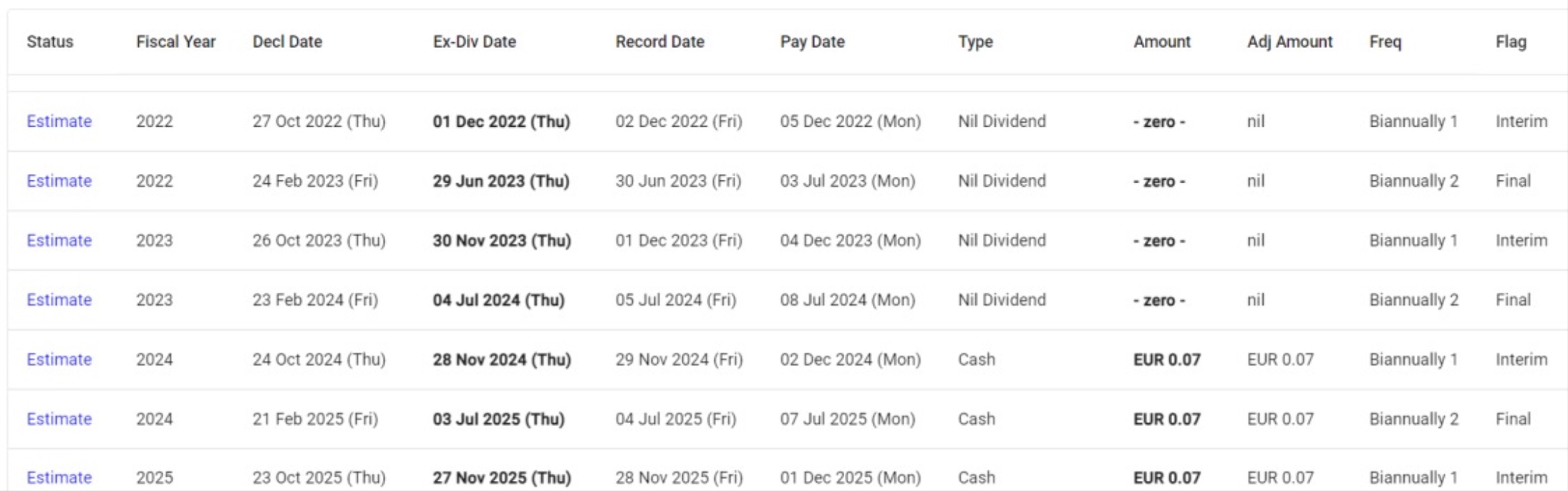

The company hasn’t paid a dividend since December 2019. We don’t expect a dividend before 2024, with the company forecasted to pay €0.07, ex-div date November 28, 2024.

Get Investment Decisions Right with Woodseer

The airline industry isn’t out of the woods yet. Lingering risks from a another rise in Covid-19 cases continue. The impact of rising fuel prices will also put pressure on bottom lines. Many top companies have ceased to pay dividends, including Boeing, which last paid a dividend of $2.055 in March 2020.

We believe these companies will return to paying dividends once their financials stabilise. But, as companies strive to reduce their reliance on fossil fuels, the sustainability of airline companies comes under question. Corporate travel is also slowing down, given companies’ outlook on whether such travel is necessary in the era of video conferencing. Then there is the question of debt repayment. All these conditions explain why the airline industry is struggling to get back on its feet.

With Woodseer Global’s unique analyst+algorithm approach, dividend forecasting for the airline sector becomes easier, despite the uncertain climate. We are trusted by world-renowned companies for our accuracy and real-time forecasts that have stood the test of time.

Contact us to learn more.