The Russian invasion of Ukraine led to major economies, such as the US, EU, UK, Canada and Japan imposing sanctions on Russia. These sanctions were broad-based and included a ban on Russian commodities but also secondary trade in government bonds. Germany went so far as to stop the certification of the Nord Stream 2 gas pipeline.

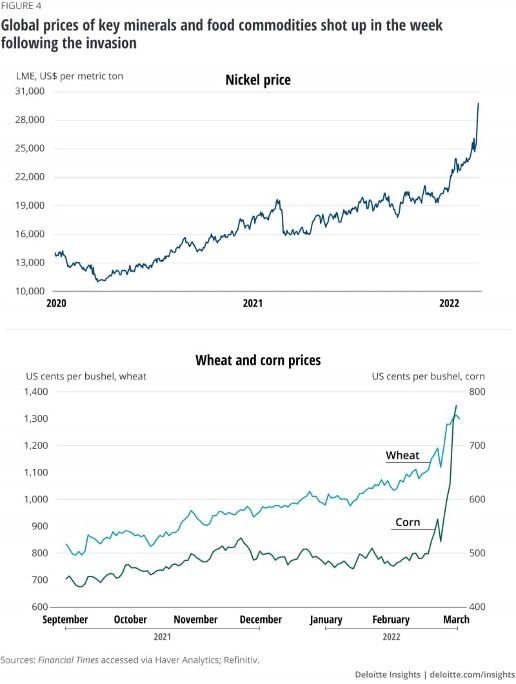

The impact of the sanctions was immediately felt on the financial markets, with the stock markets plunging on fears of inflation and a global recession. The stock markets continue to be volatile due to the uncertainty associated with the Russia-Ukraine conflict. However, the major brunt of the sanctions has been on the commodities markets. Russia and Ukraine are major exporters of energy, grains and fertilizers. In fact, the two nations contribute 25% of the grain trade and 30% of wheat exports globally.

The Impact of Russian Sanctions on Commodities

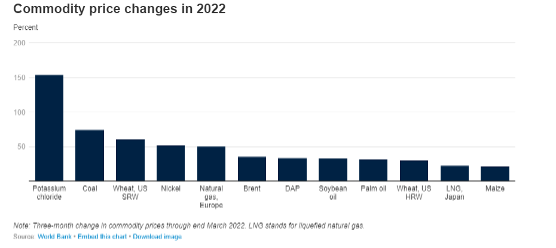

There are two ways in which the continuing conflict and sanctions are impacting the commodities markets. Firstly, Russia is the largest exporter of wheat, natural gas, pig iron, nickel, crude oil, coal and refined aluminium product exports. So, trade sanctions mean that these commodities are no longer being imported by numerous nations.

Secondly, the conflict has led to blockades, restriction of Russian vessels at various ports worldwide and destruction of production capacity. For instance, Ukraine is a key exporter of wheat and sunflower seed oil. But its exports flow through ports in the Black Sea, such as Odesa and Chornomorsk, where the commodities are loaded onto ships for Europe and Asia. However, ports have been targeted by the conflict, which means that exports now need to be transported through rail routes via Poland and Romania. This has hugely reduced the quantity of exports.

Such trade disruptions have severely impacted the EU and some Emerging Markets and Developing Economies (EMDEs). For instance, the EU imports 40% of its coal, 35% of its natural gas and 20% of its crude oil from Russia. EMDEs, on the other hand, are heavily dependent on Russia and Ukraine for their food supplies.

A deeper impact has been felt worldwide due to the escalating prices of commodities, against the backdrop of an already tight commodities markets, driven by the significant recovery in demand. The prices of nickel and aluminium had already soared to multi-year highs before the sanctions, driven by fear of supply disruptions.

As of May 2022, 25 million tonnes of wheat and corn, which is equivalent to the annual grain consumption of the least developed economies worldwide, were trapped in Ukraine. Ukraine and Russia also account for 29% of the world’s barley trade and 75% of sunflower oil. The result has been that wheat prices have risen 53% since the beginning of 2022.

In May, the United Nations warned that the continuing Russia-Ukraine conflict has created a global food crisis that “could last for years if it goes unchecked.” The UN’s food and agricultural price index had touched an all-time high of almost 160 points in March, while grain and meat price indices also reached record highs.

Winners in the Commodity Constraint Environment

The good news, however, is that some companies have shown excellent supply chain management amid all this disruption. As of Ma

Cisco Systems, Inc. (NASDAQ: CSCO)

The American tech giant designs, manufactures and sells Internet Protocol-based networking products and services for the communications and IT industries. Its focus on continually adapting to the changing environment, both externally and internally, has helped the company drive consistent growth.

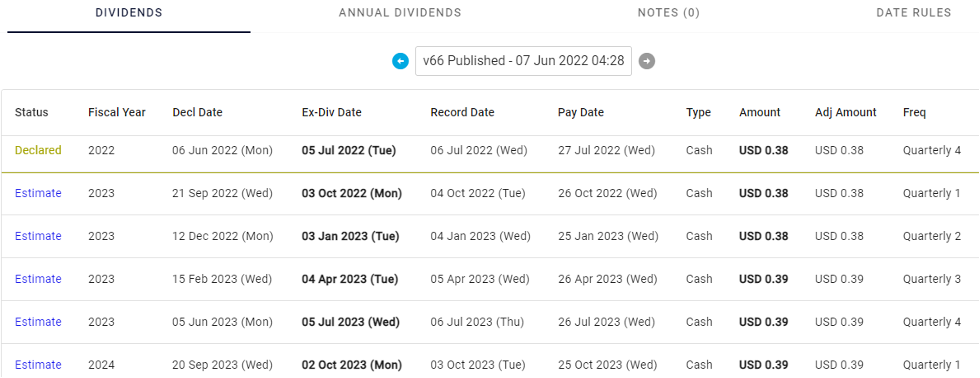

Cisco Systems declared a quarterly dividend of $0.38 on June 6, 2022, ex-div date of July 5, 2022. We expect the company to raise its quarterly dividend to $0.39 by Q3 2023.

Schneider Electric SE (EPA: SU)

This provider of digital solutions for energy management and automation received the 2022 Gartner Power of the Profession Award for Process/Technology Innovation for its initiatives on the “self-healing supply chain.”

The company’s last dividend was $2.90 for 2021, ex-div date of May 17, 2022. We expect Schneider Electric to raise its fiscal 2024 dividend to $3.10, ex-div date of May 5, 2025.

Colgate-Palmolive Company (NYSE: CL)

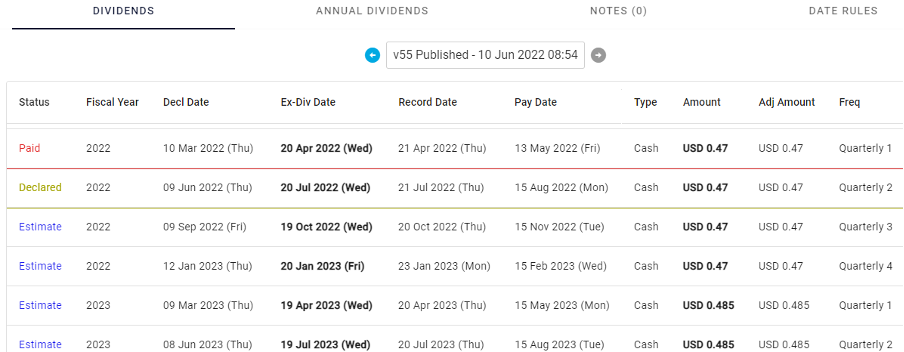

The consumer products giant has reinvented its supply chain strategy, focusing on sustainability and digitalisation, while delivering efficiency, agility and resilience. The company declared its Q2 2022 dividend at $0.47, ex-div date of July 20, 2022.

We expect Colgate-Palmolive to raise its quarterly dividend to $0.485 by Q1 2023, ex-div date April 19, 2023.

Losers in the Commodity-Constrained Environment

Not every company has been able to reinvent itself to cope with the supply disruptions.

Walmart Inc. (NYSE: WMT)

The US-based multinational retail giant, which operates hypermarket, discount department store and grocery store chains worldwide, reported disappointing Q1 earnings in May. The company’s earnings fell 24.4% despite a 2.4% increase in revenue.

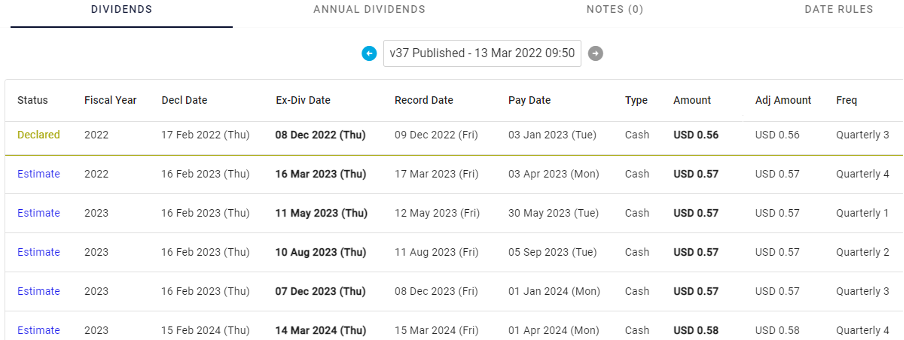

Walmart has declared its Q3 dividend at $0.57, ex-div date of December 8, 2022. We expect the company to hold its quarterly dividend stable at this level through 2023.

Target Corporation (NYSE: TGT)

Another retail giant that hasn’t fared too well, Target also reported disappointing quarterly results in May, with a 44.9% decline in earnings, despite a 4% increase in revenue. Investors punished the company for failing to protect its margins, with the stock down over 82% YTD as of June 13.

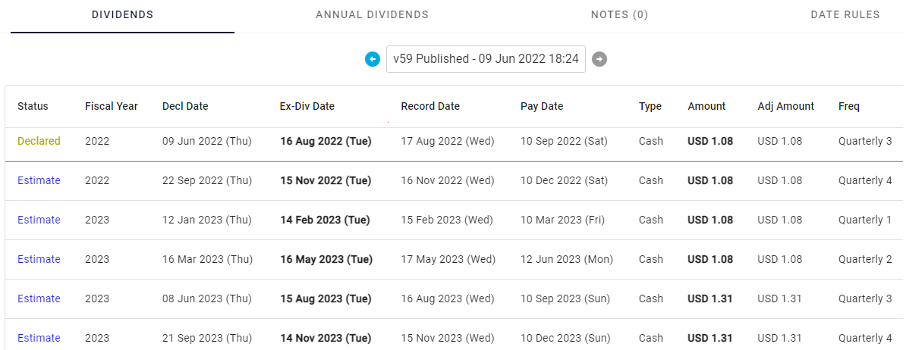

The company declared its Q3 2022 dividend at $1.08, ex-div date of August 16, 2022. We expect Target to hold its dividend steady through Q3 2023, when it could raise its quarterly dividend to $1.31.

Apple Inc. (NASDAQ: AAPL)

The consumer electronics giant reported 9% YoY growth in its Q1 revenue. However, CFO Luca Maestri warned of numerous challenges being faced by the company, not the least of which were supply constraints and a hit to sales potentially worth up to $ 8 million. The stock fell almost 4% after this announcement.

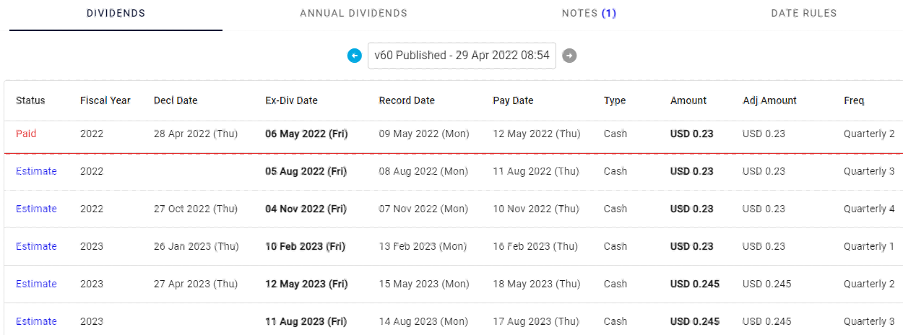

Apple paid a Q2 dividend of $0.23, ex-div date of May 6, 2022. We expect the company to raise its quarterly dividend to $0.245 by Q2 2023, ex-div date of May 15, 2023.

Stay Ahead of the Curve with Accurate Dividend Forecasting

Despite the hit on the commodities markets and supply disruptions worldwide, both winners and losers have not just sustained their dividends but are likely to increase their pay-outs in the coming years. This only goes to show that market conditions might not be the only parameter by which to make portfolio management decisions.

At Woodseer Global, we have created a niche for ourselves with reliable, accurate and real-time dividend forecasting, using a unique analyst+algorithm approach. The AI and machine learning-driven algorithms automate vast quantities of calculations to deliver accuracy at scale. With cutting-edge technology taking care of the calculations, our analysts are able to focus on providing responsive support regarding predictions, reviewing special cases and more. Contact us to learn more.