The fight against inflation is intensifying with each passing month. The central banks of almost every country are being forced to take serious steps to mitigate this looming threat. The compounding damage from the COVID-19 pandemic and the Russian invasion of Ukraine has significantly contributed to the slowdown in the global economy.

Global economic growth is expected to slump from 5.7% in 2021 to 2.9% in 2022, which is remarkably lower than the anticipated rate of 4.1% in January. So, the risk of inflation could be difficult to avoid for many countries. Even the per capita income level in developing economies is expected to be nearly 5% below its pre-pandemic trend in 2022. The wage-price dynamics are worsening and rising price expectations are too big to ignore.

While it can be argued that the global inflation levels may moderate by 2023, they are still likely to remain above the inflation targets in many economies. Now, the central banks need to walk a tight rope between ensuring fiscal sustainability and mitigating the impact of inflation on their poorest citizens. Unfortunately, the only tool in their arsenal is interest rate hikes. Here’s a look at the position taken by major central banks.

The US Federal Reserve’s Stance

The Biden administration has been scrambling to keep a check on inflation. President Biden has pushed oil refineries to ramp up production while proposing a three-month gas tax holiday. He has also asked the Federal Reserve to take necessary steps to cool down an overheating economy.

Fed officials are sticking to a restrictive policy and intend to fight inflation through hawkish rate hikes. They have proposed raising interest rates by either 50 or 75 basis points at their July meeting. They have also admitted that it is critical to work on long-term inflation goals even if it results in an economic slowdown for the short term.

The Bank of England’s Decision

Britain’s main inflation rate rose to a 40-year high of 9.1% in May 2022. The Bank of England (BoE) has warned that the rate may climb further to 11% by autumn. The BoE has raised interest rates five times since December 2021 to check soaring prices. The rate was increased from 0.1% to 0.25% in December 2021, 0.5% in February 2022, 0.75% in March, and then to 1% in May.

The Bank of England’s Monetary Policy Committee (MPC) has set its inflation rate target at 2%. At its June 15 meeting, the MPC voted to increase the bank rate again by 0.25 percentage points to 1.25%. However, some economists argue that the BoE may be forced to raise these rates to as high as 3% by the end of 2023 to achieve the set target.

The European Central Bank’s Plan

The Eurozone’s debt has begun to haunt the European Central Bank’s (ECB) policymakers, who previously supported increased public spending. The annual inflation rate projections have reached 6.8% for 2022, primarily due to surging energy and food prices, following the Russia-Ukraine conflict.

Consequently, the ECB’s Governing Council has decided to end net asset purchases as of July 1, 2022. It will continue to fully reinvest principal payments from maturing securities purchased under the Asset Purchase Programme for an extended period of time, past the date when it starts raising the key ECB interest rates. It has also decided to incorporate climate change into monetary policy operations. The ECB and associated national central banks are planning to reinvest corporate bonds that are due to mature, starting October 2022.

But the Governing Council also admitted that further steps are required to normalise its monetary policy. That is why it has proposed raising the key interest rates by 25 basis points at its July meeting. Another hike is expected in September, depending on the trajectory of medium-term inflation.

Best Stocks to Invest in During a Recession

Economists are anticipating the global economy to go into recession in the near future. The global stock markets have already plunged to their lowest levels since November 2020, with a bear market being witnessed across the world. Against the backdrop of limited options with central banks and the growing fear of recession, which stocks should be included in investment portfolios? Here’s a look.

1. Johnson & Johnson (NYSE: JNJ)

The healthcare products giant is one of the biggest American firms and has a history of consistent dividend payments for 50 years now. Analysts believe that it could be a good idea to buy the current dip or miss out on this opportunity if inflation falls in the coming months.

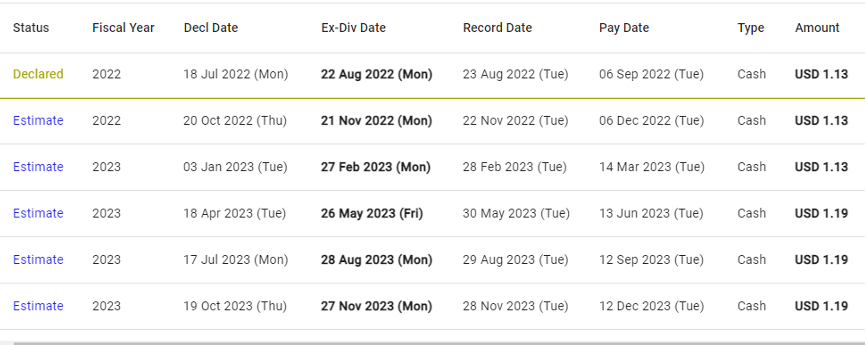

The company has declared its July dividend at $1.13, ex-div date of August 22, 2022. We expect Johnson & Johnson to raise its dividend to $1.19 by Q2 of 2023.

2. The Coca Cola Company (NYSE: KO)

Coca Cola is widely regarded as a highly endurable and investable firm that delivers consistent earnings. The company has a history of performing well during recessions, with its sales figures increasing during economic slowdowns.

This company has a history of delivering consistently growing payouts to shareholders for the past 59 consecutive years. It declared its July dividend at $0.44, ex-div date of September 15, 2022. We predict that The Coca Cola Company will raise its dividend in Q1 2023 to $0.455.

3. The Procter & Gamble Company (NYSE: PG)

This consumer goods giant is expected to do well since consumer staples will continue to be in demand regardless of the overall economic condition. Another positive in favour of this stock during a recession is that it has a reliable dividend history of almost six decades.

The company has recently declared its July dividend at $0.9133, ex-div date of July 21, 2022. It is expected to raise its dividend in Q2 2023 to $0.984.

4. Comcast Corporation (NASDAQ: CMCSA)

Comcast ranks among Wells Fargo’s top communication services stock picks during a recession. Analysts believe it is an undervalued dividend-paying stock that is expected to soar and is priced quite reasonably at this time.

This company has declared its dividend for Q2 2022 at $0.27, ex-div date of July 5. We expect Comcast Corporation to raise its dividend to $0.295 by Q1 2023 and hold it steady for the rest of the year.

5. Chevron Corporation (NYSE: CVX)

The American multinational energy corporation ranks among Wells Fargo’s top energy stock picks for a recession, based on its favourable price-to-earnings ratio and dividend yield. The company has demonstrated growing dividends for the past six years and has a 5-year dividend CAGR of 5.07%.

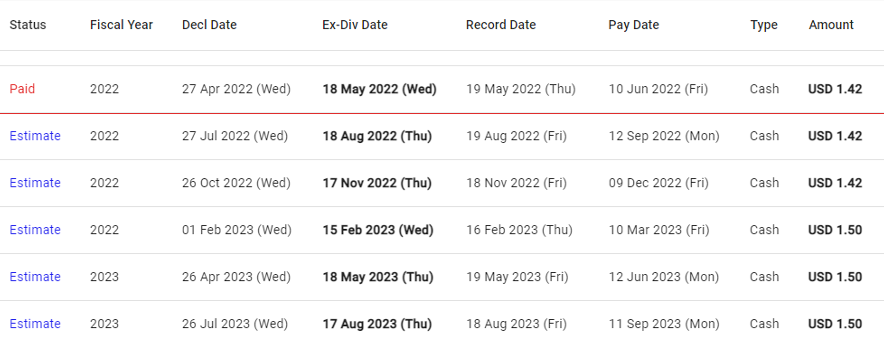

The last paid dividend was for Q1 2022 at $1.42, ex-div date of May 18. We predict that Chevron will raise its dividend in Q4 2022 to $1.50.

Best Bets for Investments with Dividend Forecasting

Choosing the right investments during uncertain times can make or break a portfolio. Reliable dividend stocks are one way to ensure passive income even during downturns. Woodseer Global employs a unique analyst + AI approach for dividend forecasting that ensures accuracy at scale. Our cutting-edge technology and skilled analysts have earned us the trust of some of the world’s largest investment firms. Contact us to learn how we can help.